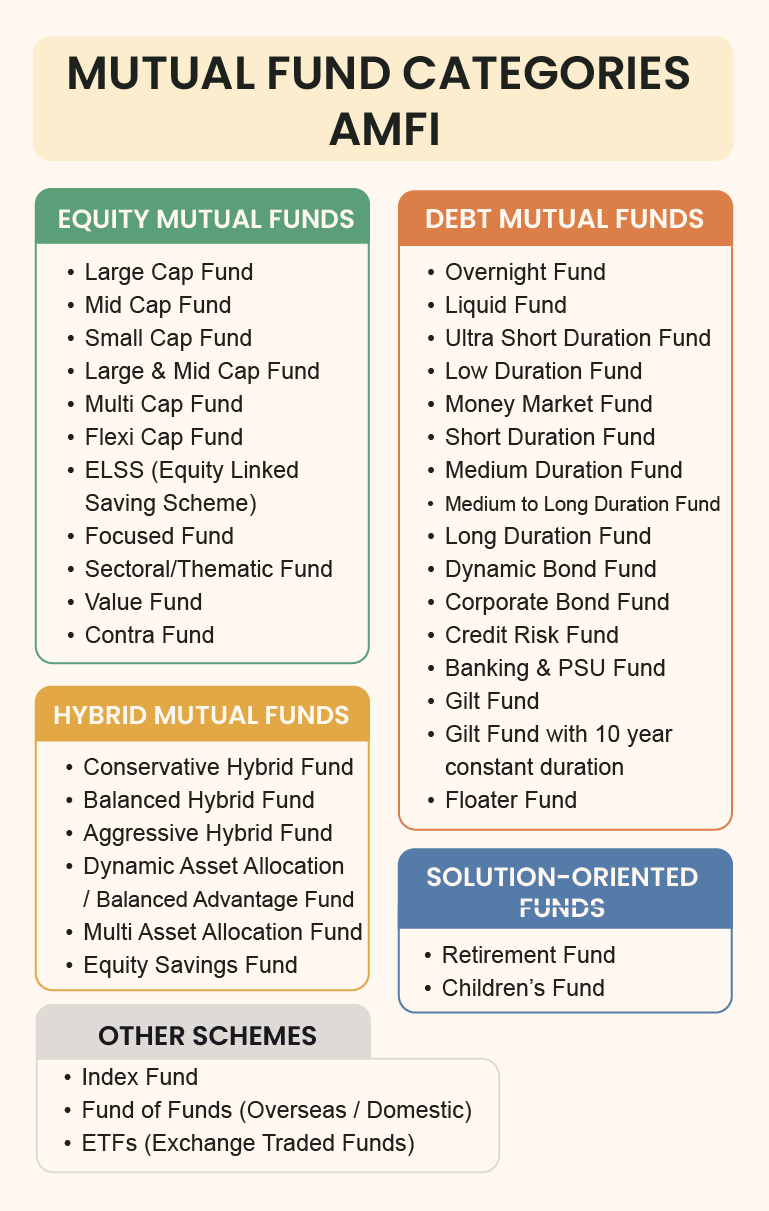

Mutual Funds

Mutual funds are investment pools that combine money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. They offer professional management, diversification, and liquidity, making them accessible to individual investors. Various types of mutual funds exist to meet different investment goals and risk tolerances.

Concept of SIP, SWP & STP

| Feature | Systematic Investment Plan (SIP) | Systematic Withdrawal Plan (SWP) | Systematic Transfer Plan (STP) |

|---|---|---|---|

| Purpose | Invest regularly over time to accumulate wealth | Withdraw regular income from an investment | Transfer funds periodically within different schemes or funds |

| Main Function | Investment approach for disciplined investing | Disinvestment method to generate regular cash flow | Fund transfer mechanism to shift money from one scheme to another |

| Suitable For | Long-term wealth creation, disciplined savings | Regular income needs, retirement planning | Rebalancing portfolio, switching funds without tax implications |

| Transaction Type | Investor invests fixed or variable amounts periodically | Investor receives fixed or variable amounts periodically | Investor transfers amounts periodically from one scheme to another |

| Tax Implication | Depends on the holding period, generally capital gains taxes apply | Capital gains taxed based on redemption period | Taxation similar to redemption or switching, depending on the timing |

| Flexibility | Flexible in amount and frequency | Flexible in withdrawal amount and frequency | Flexible transfer amount and frequency |

| Ideal For | Building corpus gradually over time | Creating a steady income stream from investments | Effectively managing or rebalancing a portfolio |

| Examples PDF | 📄 View SIP Examples (PDF) | 📄 View SWP Examples (PDF) | 📄 View STP Examples (PDF) |

| Systematic Investment Plan (SIP) | |

|---|---|

| Purpose | Invest regularly over time to accumulate wealth |

| Main Function | Investment approach for disciplined investing |

| Suitable For | Long-term wealth creation, disciplined savings |

| Transaction Type | Investor invests fixed or variable amounts periodically |

| Tax Implication | Depends on the holding period, generally capital gains taxes apply |

| Flexibility | Flexible in amount and frequency |

| Ideal For | Building corpus gradually over time |

| Examples PDF | 📄 View SIP Examples (PDF) |

| Systematic Withdrawal Plan (SWP) | |

|---|---|

| Purpose | Withdraw regular income from an investment |

| Main Function | Disinvestment method to generate regular cash flow |

| Suitable For | Regular income needs, retirement planning |

| Transaction Type | Investor receives fixed or variable amounts periodically |

| Tax Implication | Capital gains taxed based on redemption period |

| Flexibility | Flexible in withdrawal amount and frequency |

| Ideal For | Creating a steady income stream from investments |

| Examples PDF | 📄 View SWP Examples (PDF) |

| Systematic Transfer Plan (STP) | |

|---|---|

| Purpose | Transfer funds periodically within different schemes or funds |

| Main Function | Fund transfer mechanism to shift money from one scheme to another |

| Suitable For | Rebalancing portfolio, switching funds without tax implications |

| Transaction Type | Investor transfers amounts periodically from one scheme to another |

| Tax Implication | Taxation similar to redemption or switching, depending on the timing |

| Flexibility | Flexible transfer amount and frequency |

| Ideal For | Effectively managing or rebalancing a portfolio |

| Examples PDF | 📄 View STP Examples (PDF) |

| Feature | Systematic Investment Plan (SIP) | Systematic Withdrawal Plan (SWP) | Systematic Transfer Plan (STP) |

| Purpose | Invest regularly over time to accumulate wealth | Withdraw regular income from an investment | Transfer funds periodically within different schemes or funds |

| Main Function | Investment approach for disciplined investing | Disinvestment method to generate regular cash flow | Fund transfer mechanism to shift money from one scheme to another |

| Suitable For | Long-term wealth creation, disciplined savings | Regular income needs, retirement planning | Rebalancing portfolio, switching funds without tax implications |

| Transaction Type | Investor invests fixed or variable amounts periodically | Investor receives fixed or variable amounts periodically | Investor transfers amounts periodically from one scheme to another |

| Tax Implication | Depends on the holding period, generally capital gains taxes apply | Capital gains taxed based on redemption period | Taxation similar to redemption or switching, depending on the timing |

| Flexibility | Flexible in amount and frequency | Flexible in withdrawal amount and frequency | Flexible transfer amount and frequency |

| Ideal For | Building corpus gradually over time | Creating a steady income stream from investments | Effectively managing or rebalancing a portfolio |

| Examples PDF | 📄 View SIP Examples (PDF) | 📄 View SWP Examples (PDF) | 📄 View STP Examples (PDF) |